Bob Vallier, a Paris resident who has mostly lived outside the United States for the past 30 years, has already voted in his home state of Michigan for the Nov. 5 election.

“I know that whatever happens in America affects the rest of the world. I know this because I’ve lived in the rest of the world,” said Vallier, the LGBTQ+ caucus chair for Democrats Abroad.

Vallier’s vote, and the ballots of other Americans overseas, may be crucial in the tight races of battleground states like his. Michigan is one of the election’s most competitive states, with latest polls showing Democratic candidate Kamala Harris holding a slight edge over Republican rival Donald Trump.

The Democratic National Committee estimates that 1.6 million U.S. voters abroad are eligible to vote in one of the seven so-called swing states – Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin – that will likely determine the outcome of the election.

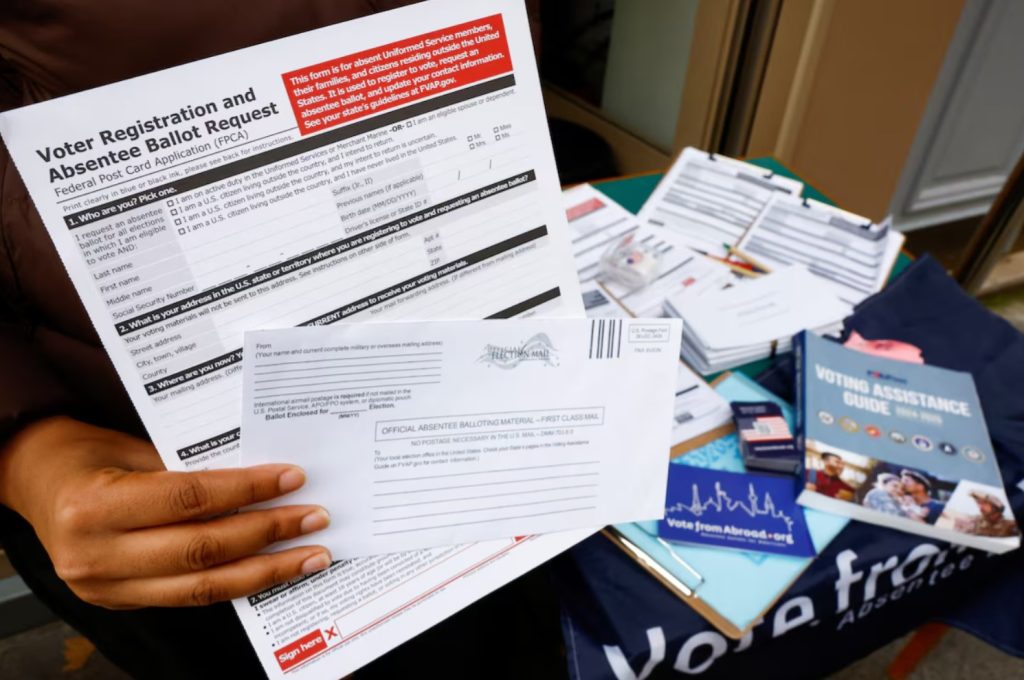

The group is believed to favor Democrats. Among people who used Vote From Abroad, a non-partisan voter support tool linked to the DNC, three-quarters of overseas voters in the 2020 election said they were Democrats.

So for the first time in a presidential election the DNC has given Democrats Abroad funding – around $300,000 – to help register Americans overseas to vote and ramp up its mail-in voting operations and other efforts. It has taken out ads on social media urging Americans abroad to send in their ballots.

“This election will be won on the margins, and every single vote counts,” said DNC spokesperson Maddy Mundy in a statement. “We’re going to win this election by engaging every eligible voter, no matter where they live.”

TRUMP’S CAMPAIGN LOOKS AT TAX RED TAPE

Republican presidential candidate Trump is also after American expatriates. Earlier this month he said he would end the double taxation of overseas Americans.

The former president’s campaign has not offered further detail on how the policy would work but it could end a burdensome requirement that mandates U.S. citizens to file income taxes in the United States regardless of where they live.

While Americans abroad do not have to pay U.S. tax on their first $126,500 in earned income and are eligible for some foreign tax credit, it can be a bureaucratic headache expatriates from many other countries don’t face.